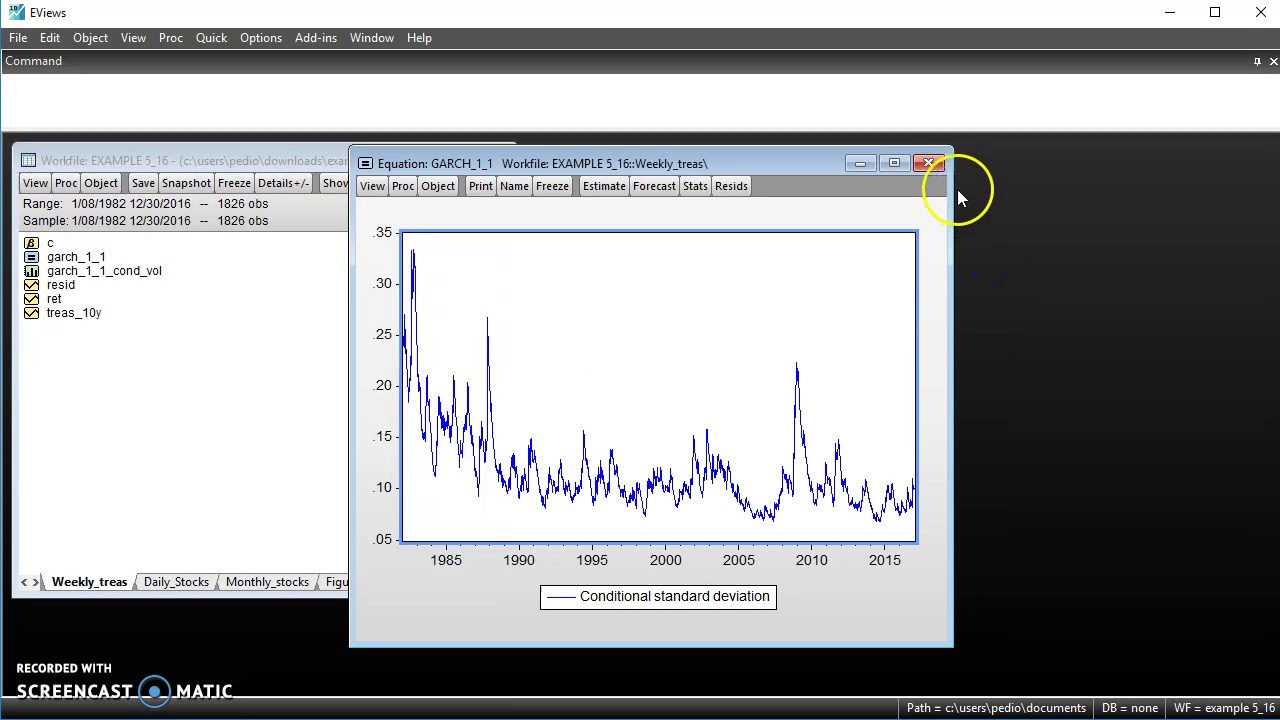

Fill in the restrictions as specified in the model with NA for the value to be estimated 16. Eviews will bring up the following (next page). '''''' Góes, C ( 2016) "Testing Piketty: Evidence from Structural Panel VARs with Heterogeneous Dynamics. Click object/new object and choose Matrix- Vector-Coef. '''''' This code implements the model developed for '''''' Coded by Carlos Gó es (andregoes International Monetary Fund The key to Pedroni (2013) estimation and identification method will be the assumption that structural shocks can be decomposed into both common and idiosyncratic structural shocks, which are mutually orthogonal.Īssociated with the $M\times1$ vector of demeaned panel data, $z_i(L)$ responses to describe properties of the confidence interval quantiles.'''''' PANEL STRUCTURAL VAR WITH HETEROGENEOUS DYNAMICS AND CONFIDENCE INTERVALS FOR MEDIANS Finally, the model is simulated in a historical simulation and stochastic simulations. A policy rule for the policy variable is also included. In this blog, we describe the econometric estimation and implementation of the Panel SVAR of Pedroni (2013). (e) The EViews model is built by appending behavioral equations and a number of technical or definition equations. Therefore, some researchers want to implement a panel SVARs to evaluate certain exogeneity assumptions or to test the small open economy assumption, often made in the international economics literature. Researcher may also be interested in knowing whether inflation dynamics in states may depend on political, geographical, cultural or institutional features, or on whether monetary and fiscal interactions are related.Īlternative potential use of panel SVARs is in studying the importance of interdependencies, and in checking whether reactions are generalized or only involve certain pairs of units. For example, researcher may analyze if monetary policy is more countercyclical, on average, in countries or states. Panel SVARs have also been often used to estimate average effects – possibly across heterogeneous groups of units - and to describe unit specific differences relative to the average. Structural Vector Autoregression (SVAR) models.

In terms of time series modeling, both predict values of a dependent variable beyond the time period in which the model is estimated. interest rate shocks are propagated to 10 European economies, 7 in the Euro area and 3 outside of it, and how German shocks are transmitted to the remaining nine economies. Feb 12, 2018Aug 31, 2018In this tutorial, I will teach you how to estimate structural var models in eviews. Forecasting Using Eviews 2.0: An Overview Some Preliminaries In what follows it will be useful to distinguish between ex post and ex ante forecasting.

Panel SVARs are particularly suitable to analyze the transmission of idiosyncratic shocks across units and time. Panel SVARs have been used to address a variety of issues of interest to policymakers and applied economists. Author and guest blog by Davaajargal Luvsannyam

0 kommentar(er)

0 kommentar(er)